|

|

||

|

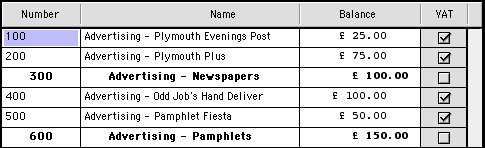

Expense Accounts |

|||||

|

|

The

Expense Accounts window lets you divide up the different ways in

which your business spends money. The list shows you the balance for

each account or, in other words, how much money has been spent on a particular

area since the start of the current financial year. Adding

Accounts

This window will allow you to create the new account. You may use whatever name you wish, and whatever number you wish. However, you need to take account of how the number will be used. Numbers are used to set the order of the accounts in the list of Expense Accounts shown at the top of this page. This order is important because of the two types of account that may be created. There are Detail accounts and Total accounts. Detail accounts are used to divide up the ways in which the money is spent. Total accounts are used to add up the balances of the different Detail accounts above it in the list. Let's go back to the example given earlier of the gardener to see how this is useful. The gardener could advertise in different local newspapers, and use different delivery companies for the pamphlets. It would be useful to see how much money is spent on each newspaper, and how much is spent on each delivery company. So, Detail accounts would be set up for each newspaper and pamphlet delivery company and Total accounts for each of the different advertising methods. The numbers of the accounts would be chosen so that when they are listed in numeric order, each Total account adds up the appropriate Detail accounts, as shown below.

As

well as deciding the name, number and type of account, you will also

need to decide if you want the program to track VAT when you make an

entry for a particular account.

|

||||